Banking Domain Application Testing: Sample Test Cases

Banking Domain Testing is a software testing process of a banking application for functionality, performance, and security. The main purpose of testing banking application is to ensure that all the activities and functionalities of a banking software run smoothly with no errors and it remains protected.

The BFSI (Banking, Financial services and Insurance) sector is the biggest consumer of IT services. Banking Applications directly deal with confidential financial data. It is mandatory that all the activities performed by banking software run smoothly and without any error. Banking software perform various functions like transferring and depositing fund, balance inquiry, transaction history, withdrawal and so on. Testing banking application assures that these activities are not only executed well but also remain protected from hackers.

What is Domain in Testing?

Domain in Testing is nothing but the industry for which the software testing project is created. When we talk about software projects or development, this term is often referred to. For example, Insurance domain, Banking domain, Retail Domain, Telecom Domain, etc.

Usually, while developing any specific domain project, domain expert help is sought out. Domain expert are master of the subject, and he may know the inside-out of the product or application.

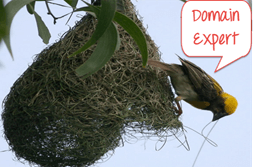

Why Domain Knowledge Matters?

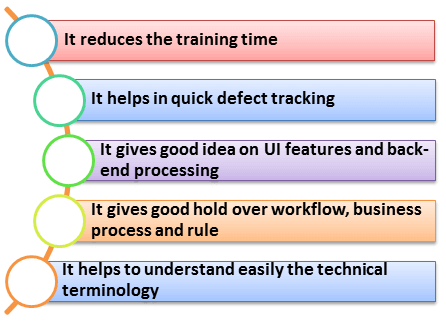

Domain knowledge is quiet essential for testing any software product, and it has its own benefits like

Banking Domain Knowledge – Introduction

Banking domain concepts are huge, and basically it is sub-characterized into two sectors

Below is the table of the services these two sub-sectors of banking encompass

- Core banking

- Corporate banking

- Retail banking

- Core

- Corporate

- Retail

- Loan

- Trade finance

- Private banking

- Consumer finance

- Islamic banking

- Customer delivery channels/Front end delivery

Based on the scope of your project you may need to test one or all of the above service offerings. Before you begin testing, ensure you have enough background on the service being tested.

Characteristics of a Banking Application

Before you begin testing, it’s important to note the standard features expected of any banking application. So that, you can gear your test efforts to achieve these characteristics.

A standard banking application should meet all these characteristics as mentioned below.

- It should support thousands of concurrent user sessions

- A banking application should integrate with other numerous applications like trading accounts, Bill pay utility, credit cards, etc.

- It should process fast and secure transactions

- It should include massive storage system.

- To troubleshoot customer issues, it should have high auditing capability

- It should handle complex business workflows

- Need to support users on multiple platforms (Mac, Linux, Unix, Windows)

- It should support users from multiple locations

- It should support multi-lingual users

- It should support users on various payment systems (VISA, AMEX, MasterCard)

- It should support multiple service sectors (Loans, Retail banking etc.)

- Foolproof disaster management mechanism

- What is Software Testing?

- 7 Principles of Software Testing with Examples

- V-Model in Software Testing

Test Phases in Testing Banking Applications

For testing banking applications, different stages of testing include

- Requirement Analysis: It is done by business analyst; requirements for a particular banking application are gathered and documented

- Requirement Review: Quality analysts, business analysts, and development leads are involved in this task. The requirement gathering document is reviewed at this stage, and cross-checked to ensure that it does not affect the workflow

- Business Requirements Documentation: Business requirements documents are prepared by quality analysts in which all reviewed business requirements are covered

- Database Testing: It is the most important part of bank application testing. This testing is done to ensure data integrity, data loading, data migration, stored procedures, and functions validation, rules testing, etc.

- Integration Testing: Under Integration Testing all components that are developed are integrated and validated

- Functional Testing: The usual software testing activities like Test Case preparation, test case review and test case execution is done during this phase

- Security Testing: It ensures that the software does not have any security flaws. During test preparation, QA team needs to include both negative as well as positive test scenarios so as to break into the system and report it before any unauthorized individual access it. While to prevent from hacking, the bank should also implement a multi-layer of access validation like a one-time password. For Security Testing, automation tools like IBM AppScan and HPWebInspect are used while for Manual Testing tools like Proxy Sniffer, Paros proxy, HTTP watch, etc. are used

- Usability Testing: It ensures that differently able people should be able to use the system as normal user. For example, ATM with hearing and Braille facility for disabled

- User Acceptance Testing: It is the final stage of testing done by the end users to ensure the compliance of the application with the real world scenario.

Sample Test Case for Net Banking Login Application

Security is prime for any banking application. Therefore, during test preparation, QA team should include both negative and positive test scenarios in order to sneak into the system and report for any vulnerabilities before any unauthorized individual get access to it. It not only involves writing negative test cases but may also include destructive testing.

Following are generic test cases to check any banking application

- Verify Admin login with valid and Invalid data

- Verify admin login without data

- Verify all admin home links

- Verify admin change password with valid and invalid data

- Verify admin change password without data

- Verify admin change password with existing data

- Verify admin logout

- Create a new branch with valid and invalid data

- Create a new branch without data

- Create a new branch with existing branch data

- Verify reset and cancel option

- Update branch with valid and invalid data

- Update branch without data

- Update branch with existing branch data

- Verify cancel option

- Verify branch deletion with and without dependencies

- Verify branch search option

- Create a new role with valid and invalid data

- Create a new role without data

- Verify new role with existing data

- verify role description and role types

- Verify cancel and reset option

- Verify role deletion with and without dependency

- verify links in role details page

- Verify all visitor or customer links

- Verify customers login with valid and invalid data

- Verify customers login without data

- Verify banker’s login without data

- Verify banker’s login with valid or invalid data

- Create a new user with valid and invalid data

- Create a new user without data

- Create a new user with existing branch data

- Verify cancel and reset option

- Update user with valid and invalid data

- Update user with existing data

- Verify cancel option

- Verify deletion of the user

Challenges in testing Banking domain & their Mitigation

Challenges tester might face during testing banking domain are

- Ensure that test data meets regulatory compliances requirements and guidelines

- Maintain the data confidentiality by following techniques like data masking, synthetic test data, testing system integration, etc.

The biggest challenge in testing banking system is during the migration of the system from the old system to the new system like testing of all the routines, procedures and plans. Also how the data will be fetched, uploaded and transferred to the new system after migration

- Ensure Data Migration Testing is complete

- Ensure Regression Test cases are executed on old and new systems, and the results match.

- There may be the cases where requirements are not documented well and may lead to functional gaps in test plan

- Many non-functional requirements are not fully documented, and testers do not know whether to test it or not

- The test should participate in the project right from Requirement Analysis phases and should actively review the Business Requirements

- The most important point is to check whether the said system follows the desired policies and procedures

- Compliance or Regulatory Policies testing must be done

- The scope and the timelines increases as banking application are integrated with other application like internet or Mobile banking

- Ensure Time budget for Integration Testing is accounted if your banking application has many external interfaces

Summary

Banking domain is the most vulnerable area for cyber-theft, and safeguarding the software requires precise testing. This tutorial gives a clear idea of what it takes for banking domain testing and how important it is. One must understand that –

- Majority of banking software are developed on Mainframe and Unix

- Testing helps to lessen possible glitches encounter during software development

- Proper testing and compliance to industry standards, save companies from penalties

- Good practices help develop good results, reputation and more business for companies

- Both manual and automated testing have respective merits and usability